Like clockwork, the annual Forbes MLB valuations roteere released yesterday, just prior to the start of the regular season. Unlike last year (which I didn’t bother to write about), there were several surprises. The biggest was the Giants’ 100% boost from $1 billion to $2 billion, on the strength of the team’s third World Series win and development potential at Mission Rock.

The other surprise was the huge gains for small market teams, led by the Royals, Indians, and yes, your Oakland Athletics. Forbes awarded the A’s a 46% gain, from $495 million last year to $725 million this year. While many revenue-related factors are responsible, Forbes also chose to up its revenue multiplier in determining the valuations, which had been falling behind actual sale prices in what has been over the last several years a hot seller’s market.

Higher enterprise ratios are being fueled by the stock market’s six-year bull run (which has inflated asset values and created a lot more buyer than seller of teams), baseball’s unmatched inventory of live, DVR-proof content, real estate development around stadiums, higher profitability (which reduces the need for capital calls) and the incredible success of Major League Baseball Advanced Media, the sports’ digital arm that is equally-owned by the league’s 30 teams.

Even the new A’s valuation may be behind the teams a bit. When Bloomberg released its own independently derived valuations after the 2013 season, then-PR man Bob Rose suggested that the number was closer to $700 million based on revenue. Before franchises started going for insane amounts, it was common for franchise owners – including Lew Wolff – to claim that Forbes’ numbers were incorrect, overselling certain aspects of a franchise’s operation. Now we’re starting to approach $1 billion for a team that has at best average TV/radio deals and no new stadium. A 300% return in a decade is pretty impressive, no matter how slice it – though Wolff and John Fisher can’t realize that until they sell the club. They’ve shown no indication that they’re interested in selling, despite how much the stAy crowd clamors for it.

As nice as the new valuation looks, it’s miles from where the Giants, Dodgers, and almighty Yankees ($3.2 billion) are. The Bronx Bombers recorded more than $500 million in revenue last year, confirming a quote from an unnamed Yankee exec in the fall. The luxury tax was designed to dissuade teams from profligate spending, but until recently that hasn’t stopped the Yankees and the Dodgers don’t seem to care one iota about the luxury tax. Redefining luxury tax penalties may become a sticking point in the next CBA negotiations, one that goes hand-in-hand with shifting the revenue sharing model for lower revenue (small market) franchises.

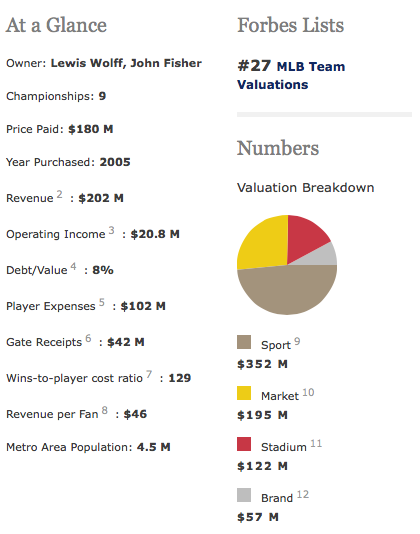

Let’s do a deeper dive into the Forbes figures. First the A’s:

Forbes breakdown of the A’s valuation

Now the Giants:

Forbes’ Giants valuation

In nearly every key measurable, the Giants double or even quadruple the A’s. The Giants hit a perfect storm of on-field success and savvy management, which was parlayed into impressive revenues. The Giants are a money-making machine. They are also a big market club, no doubt. Though they aren’t profligate spenders in terms of payroll, everything else about them is big market, just like the Yankees, Dodgers, and Red Sox.

The A’s, on the other hand, bear all the marks of a small market team. Gate revenues are abysmal compared to the Giants. It’s so lacking that the A’s could untarp all the regular upper deck seats, sell out the entire season, and still only reach 50% of the Giants’ revenue. The flipside to that is that the A’s are a far more affordable, accessible product for baseball fans in the Bay Area. The market itself, which is defined as the East Bay, compares to a lot of other small markets like Tampa Bay and Kansas City. As long as the A’s are pigeonholed to the East Bay, it’s likely they’ll remain small market, or perhaps boost themselves to a medium-sized market if a new stadium comes.

New and improved national media revenues are the tide that has lifted the A’s boat. As big market teams keep getting bigger and bigger annual revenues, the A’s will continue to be a club that receives a nice revenue sharing check, at least as long as they play at the Coliseum. Per the current CBA, they’ll continue to be eligible for revenue sharing until they start playing in a new Bay Area ballpark. So the A’s are in a sort of limbo in which right now they’re considered a small market team in that they receive revenue sharing, but will be redefined as a big market team once they open a new park. That arrangement could continue into the next CBA, or it could change. I suspect that if the A’s build a new park in Oakland, they’ll remain a small market team by definition, simply because they don’t have the same direct access to big sponsors as they would in San Francisco or San Jose.

The other big takeaway from the valuation news is that the A’s debt position has significantly improved from doing nothing. Forbes reports that the A’s debt is now 8% of franchise value, or around $60 million. That leaves an astounding $665 million of equity for the ownership group. Wolff has suggested that he would use equity to help finance a ballpark. He could conceivably cover the entire cost with the team’s equity, but MLB rules about debt load preclude such a plan. The most debt the A’s can accrue without running afoul of MLB is 12 times their operating income if they’re building a new ballpark, 10x if not. If you take the average of income from the last three years you get $25 million. Multiply that by 12 and you get $300 million. The A’s have $60 million of existing debt, but according to MLB rules they can exempt $40 million of that. Combine all of those together and the A’s can in theory finance $280 million of a stadium. Even with the added debt, chances are that by the time the stadium opens it would hit only 35-40% of the franchise’s value, an acceptable amount for a sports franchise.

Naturally, the problem is servicing that debt. $280 million over 30 years at 4% is $16 million a year. To ensure that gets covered and it doesn’t have a deleterious effect on payroll, the A’s would have to get 30-32,000 average attendance per game for several seasons, at much more expensive prices than the Coliseum to boot. Then there’s the combination of suite sales, sponsorships, and maybe even seat licenses if fans are willing to invest. If this sounds similar to what the Giants did, that’s because it is. Maybe there’s a real estate component that can come in to offset that debt service requirement, but Wolff indicated in recent comments that grand development concept such as Coliseum City is not forthcoming from him.

Nevertheless, if Wolff and Fisher want to build, and fans are willing to pay, the path is there. Getting to a deal is the hard part.

—

P.S. – Speaking of getting to deal, there’s been some noise about wanting Wolff to show his plans. Show a rendering, something to indicate that he actually wants to build in Oakland. To which I say – come on. He just finished opening a soccer stadium, the spring training facility renovation, and is finishing scoreboards at the Coliseum. Are those not indicators of wanting to build?

All of these sentiments, while well-placed, are based on some unrealistic expectations. Fact is that the stadium development process is dog slow. It’s tedious. No premature release of renderings will do anything other than getting a small handful of fans excited. Believe me, I’m one of them. But I’ve also learned over the years is that all of that is sizzle, not steak. If you want real progress, you need rules. You need a framework. Here’s the “framework” for the A’s right now:

That’s not a framework for anything other than random discussions between the A’s and East Bay pols. If the A’s, City, and County are going to work on an actual deal, they need to establish a real framework for talks and for a stadium/development deal. It would help if Oakland or the JPA started by creating an RFP (request for proposal), that would allow the A’s to formally propose something. The A’s are in the process of hiring a person to interface with City/County/JPA. If the Raiders wanted to present their own vision, the RFP could accommodate them too. That is how the Coliseum City process started, and is the proper – not to mention legal – way to do government business. Frankly, I’m past renderings. I want steak. You should too.

Interesting insights ML. Assuming the A’s stay a small market team and able to receive welfare even after the new CBA and stadium is built will go along way to helping a project pencil out in Oakland. In essence it will be MLB’s way to subsidize stadium construction in Oakland. Imagine taking on that $16M annual mortgage will dropping revenues by $35M. That’s a $50M+ negative impact that would need to be made up by new revenue streams- not sustainable in Oakland long term-

So let me get this straight, lew wolff cant really present his proposal until new city presents theres?

No, these things can happen independently of each other. Difference is that New City has rules and a framework to do so. Wolff doesn’t.

This is good news, if the A’s in theory can barrow up to 280 million against their own value, that will cover a large portion of the financing puzzle to get a new ballpark. Nice work ML.

@LSN- financing has really never been the issue- the issue is revenue streams to pay off the financing- in that regard there is no new information. $280M of financing still leaves $320M of other dollars needed to pay for the ballpark. Not to mention infrastructure costs. LW will be watching closely what is proposed for the raiders in terms of roundabout public subsidies. These will be key to getting 1 team to stay-

It would be assumed that the rest would be paid for by the long-term suite contracts, sponsorships, naming rights, etc. Usually for a stadium-only plan infrastructure costs are baked in.

Agree- which seems to be a stretch in the EB market to generate these kinds of revenues due to the corporate support and another baseball park 7 miles away. What pushes oakland over the top is continued welfare payments if they stay in Oakland. Hasn’t there been some rumblings about the players union not being happy with MLB holding back potential revenue streams by keeping the team in Oakland?

Both the union and prominent agents like Scott Boras have been pushing for quicker resolutions on these stadium issues. They really don’t have a say, so it matters little.

To a certain degree don’t they have a say as the CBA memoralizes the revenue sharing agreement?

Yes, long term suite contracts, sponsorships and naming rights can cover the rest of the hypothetical nearly $400 million in financing…in $J/$V! In an area the Warriors are eager to abandon and the Raiders have stated is corporate poor? Wolff is a smart businessman and I don’t see him becoming a huge Oakland philanthropist to the tune of $600 million…unless of course revenue sharing remains AND a large public subsidy is offered for ballpark construction.

I’m sure as we speak Wolff is telling Manfred re the Raiders Coli pursuit “you see what I would have to deal with in Oakland?!” And the saga continues, stay tuned…

@ Tony D.

Or Manfred could be telling Wolff as we speak, well you knew what you were getting into when you perched the A’s (in Oakland), in the first place 🙂

I’ll give you that LSN. For the record, Wolff isn’t just limited to (currently) building in Oakland re his territory. If he wanted he could make potential ballpark debt issues vanish if he built at the doorstep of $ilicon Valley/$J…

@ Tony D.

I hear you my man, I just used Oakland in reference to you using it. You and I (and other’s), talked at nauseam about Fremont and you and I pretty much saw it the same way.

@ GoA’s

There is no new information? The A’s are worth 46% more than last year (according to Forbes)), I would say that’s new. Believe me I realize financing isn’t a problem, in theory Wolff and Fisher could pay for it out of pocket. (Not that MLB would be happy with that)

This information makes building, all the more finically plausible from a standpoint that would be a little closer to the model that MLB, and perhaps Wolff and Fisher would prefer. I would guess. It certainly isn’t a cure all, and I did not make my last comment thinking it was, my friend.

@LSN- tell me one other team that MLB will request using their increased equity to privately finance a ballpark. Capital to build the ballpark has never been the question- it’s generating enough revenue (not equity) to support that investment which is the ongoing question for both the Raiders and A’s-

@GoAs

“tell me one other team that MLB will request using their increased equity to privately finance a ballpark”

I did not say or indicate, that MLB would require the A’s to use (all) their increased equity to privately finance a ballpark. Perhaps if you read what ML wrote? “Wolff has suggested that he would use equity to help finance a ballpark” does everything have to be nit-picked? I said it was good news, is it not good news? Can the A’s, not use some of their equity to help build a ballpark? (As Wolff suggested) I guess everything is bad news.

It’s tough to look at those figures and argue that an A’s team in San Jose would significantly disrupt revenues earned by the Giants.

MLB seems to be tone-deaf to the reality of these numbers & instead seems to accept the Giants’ reasons for objecting to an A’s move to San Jose as valid and non negotiable.

No business likes to lose money, but behavior of the Giants and MLB is becoming a new definition of greed.

And there is absolutely no indication that there is anyway that they will change this.

Not yet at least. Still got a LONG way to go in this saga. As John Fisher would say, “patience”…

The numbers glaringly show the fact that MLB is holding the A’s to an extreme financial and competitive disadvantage vis-a-vis the Giants. If one looks at the equity and revenue comparisons between the teams in the other existing shared LA, NY, and Chicago markets; I’m sure the disparity doesn’t equate anywhere near to the extremes between the two Bay Area teams. The numbers show that MLB has been terribly unfair to the A’s by perpetuating this unprecedented territorial division of its shared Bay Area market into two separate and unequal territories.

The Mets have revenues 52% that of the Yankees, the A’s have revenues 52% of the Giants. The O’s, White Sox and Angels have revenues 85%, 75% and 75% of the larger team in their market.

@Jeffrey Those numbers really tell the story of how well the Angels are managed and how poorly the Mets are managed.

The Mets number is SHOCKING… If any team needs a new owner, it’s that one.

For those of you who impugn the motives of the Giants where this stadium question is…you’re right.

As can be seen from the images, it is very much within SFG’s financial interest to keep things status quo – and almost all of their activity has been directed to exactly that.

Status quo or a new paradigm as a one team market. Either works for them.

One thing to note in looking through the valuations of the other teams, teams that own their stadiums have about a $300M value increase in the stadium portion of the valuation breakdown.

The A’s owning their own stadium at the Coliseum site may not command as high of an increase, but it will add significantly to their valuation. Even in East Oakland, the stadium and the land has value.

Thanks, you just added a short cut for some cypherin’ I was doing.

Assuming that is correct and $300M is the bump in value a stadium would give the A’s would move from the 27th most valued franchise to the 15th on this list (just behind the Mariners and just ahead of the Orioles). Passing the White Sox and Orioles and only behind the second valued team in the two largest markets in the country.

That sounds right to me.

Yet to privately build a stadium takes $500-$600M for a $300M bump in valuation- and you have a $50M hit in revenues if revenue sharing is taken away- and your mortgage payment is $16M annually- those are some big numbers to make up-

All true, but I’d bet Lew Wolff won’t build anything in Oakland without revenue sharing still part of the deal.

Also, I’d expect that their media deals will get better with a better stadium, but that’s hardly something we could all accurately predict.

Yes- agree on the revenue sharing- it has to be continued for things to pencil out in Oakland. Not sure on increased TV revenues- don’t know when the current deal ends and the market share of the Gints already compared to the A’s. I have to guess its significant and wouldn’t expect that to change with a new ballpark in the same location as the current one- which no matter how you slice it still adds up to a “commuter” ballpark with little to bring you into the area before the game or make you stay after the game.

Also, the A’s Brand valuation is very low. While it will never be in the neighborhood of teams like the Yankees and Dodgers, it’s got a lot of room to grow and a new stadium will cause a bump there. Playing in a stadium most known for sewage spills isn’t great for the brand 🙂

The giants worth $2 billion ? Not a chance. Only $400 mil less than the Dodgers, and less than $100 mil less than the bosox, LOL

I don’t doubt that valuation for a minute- all it takes is a Balmer type of character to drive prices to that level as we saw down in LA with the Clippers. And note there are plenty of very wealthy billionaires in the Bay Area where Money is no object.

For those who keep on hoping LW sells be careful what you wish for. I would bet the A’s would fetch $1B even while still in their current digs. Imagine trying to build a privately financed ballpark in Oakland after spending that kind of cash to acquire the team.

Right on GoA’s!

Something else for everyone to consider; it can’t just be about value (land, team, otherwise) when considering to build in Oakland or anywhere for that matter. It has to be about actual financing and not being riddled with debt. FOR EXAMPLE, what good is financing/building a $3 million dollar home if my revenue streams can’t pay the mortgage. Sure, I’m now “worth” $3 million, but….

Harping on “value” only makes sense if Wolff plans on immediately selling the team after building a new ballpark, wherever that might be.

@ Tony D.

Who’s harping on value? It’s only part of the financial puzzle, a part Wolff suggested he he may use. That part is apparently is 46% larger then last year, so he doesn’t have to leverage as much, or he can tap into a little more, that’s it nothing more or less.

Do you really think people are making more of it then that?

LSN,

This whole thread is about value and how Wolff could (supposedly) use some of the newfound “equity” to build a ballpark at the Coli. Also read some of the commentary above and from the last thread for the “harping” I’m referring to.

Value doesn’t only matter if he intends to immediately sell the team. That’s ridiculous. Value, the equity in the team, has been mentioned specifically by Lew Wolff as one way to help pay for a stadium. Borrowing against it has nothing to do with selling the team.

You always ignore inconvenient facts and twist others to mean what you want them to. It’s hilarious that you call others (I am assuming me?) for “harping” when you are a broken record.

What do you expect Jeff? He’s the resident Nav when the real Nav is away.

Yes, Wolff has stated using “equity” to help finance a ballpark…in San Jose. Not suggesting he wouldn’t do the same in Oakland, but to date he’s never stated that to the media.

Yes, borrowing against “equity” has nothing to do with selling the team…but you still have to pay for that “borrowing.” Don’t see to many folks making minimum wage opening equity lines my friend (see corporate/disposable income situation of Oakland).

@SMG, rather than debate the topic at hand, just become insulting…That’s brilliant my friend!

Forbes didn’t include the FMV of the tarps.

Manfred appears to definitely more pro A’s to San Jose than his predecessor, and also appears to pro Oakland too, what gives? (At least it’s a

Better situation than when selig was commissioner though)

@ raider/dave

That’s funny; I guess it’s better to be Pro-San Jose and Pro-Oakland then ignore the situation. But then again I guess not. Funny…

@ ‘Neil: true, although the new commish disagrees with the giant’s stance (selig wouldn’t think doing that and upsetting

the giants organization)

@ raider/ dave

I agree it fills like he wants to be more hands on and actually resolve this. Not that we would know, but I get the filling he is less sympathetic toward the SF Giants, then his predecessor. If that is even true, it certainly doesn’t mean he will do any more than his predecessor, but maybe I’m just hoping anything will get done.

I’d be careful about reading too much into Manfred’s limited comments so far. He’s keeping all sorts of options open, from nice guy to bully.

@ ML

Yes indeed the whole range from nice guy to bully, and probably everything in-between. It sue fills that way.

Why is Wolff spending $$$ on soccer that need to go into a new stadium? Hmnn?

He has the old mindset: rich people don’t put their $$$ into infrastructure, the taxpayers do it for me so I can create jobs! Putting MY $$$ in for the benefit of the community, why that is just not done! That’s socialist! Let him sell, who needs that greedy scum!